-

Damascus-QSD Agreement Continues Despite Rumors of Its Collapse… Ilham Ahmed: 'A Start for Broader Understandings'

-

The new understandings emerge as an attempt to improve living conditions for civilians in the Sheikh Maqsoud and Ashrafiyah neighborhoods, while ensuring their representation in decisions related to s

The Media Directorate in Aleppo denied circulating reports about the suspension of detainee exchanges between the Aleppo Security Directorate and the Syrian Democratic Forces (SDF), confirming that the agreement continues as per the scheduled timeline.

A source from the directorate, as reported by Syria’s official news agency SANA on Sunday, stated that security and logistical arrangements are currently underway to resume exchanges in the coming days—a step reflecting the seriousness of the involved parties in implementing the agreement despite challenges.

These statements came just two days after around 450 QSD fighters left Aleppo in a first batch, in accordance with the agreement stipulating the transfer of the Asayish forces in Sheikh Maqsoud and Ashrafiyah to the Public Security Forces under the Autonomous Administration.

According to Syrian sources, the agreement includes the release of 170 SDF detainees and nearly 400 detainees from the Public Security Administration and other factions—a significant step toward normalizing the situation in the region.

Last Friday, Aleppo witnessed the beginning of the QSD withdrawal, with the first military convoy heading east of the Euphrates under the supervision of the Syrian Ministry of Defense. Meanwhile, Syrian Army units deployed around areas previously under QSD control to secure the departing convoy.

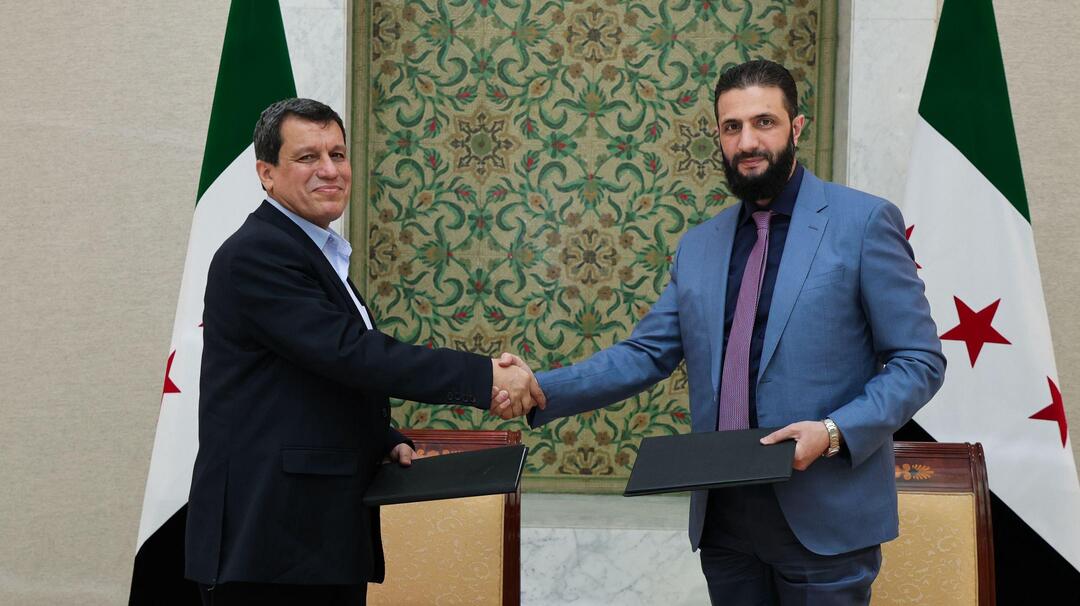

It is worth noting that the Syrian presidency announced on March 10 the signing of an agreement integrating the SDF into state institutions, reaffirming Syria’s territorial unity and rejecting division. The agreement was signed by Acting President Ahmad al-Shar’a and SDF Commander Mazloum Abdi.

Ilham Ahmed, the Co-Chair of the Foreign Relations Office of the Autonomous Administration of North and East Syria, praised the agreement signed in early April in Aleppo, describing it as a new experiment in Syria’s reality that could lead to "building a decentralized, pluralistic state ensuring the return of displaced people and ending armed conflict."

Ahmed called the agreement "positive," stressing that residents of the two neighborhoods had suffered for years from siege and lack of services, and that this understanding would improve their living conditions and provide a more stable environment.

She clarified that the agreement tasks the Asayish forces with protecting the two neighborhoods post-military withdrawal, calling it a necessary step to safeguard civilians from the repercussions of armed conflicts.

She stated: "Protecting civilian lives is essential, and this requires security guarantees from all parties, including the Asayish and official authorities in Aleppo."

Ahmed noted that the local councils in the two neighborhoods would remain operational while initiating direct coordination with the Aleppo Governorate Council in service and health sectors—a civilian-led effort aimed at fair resource distribution.

She emphasized the need to expand such understandings to other parts of Syria and establish constitutional foundations protecting rights and freedoms to prevent the country from sliding back into conflict—highlighting the importance of building on this positive step.

You May Also Like

Popular Posts

Caricature

opinion

Report

ads

Newsletter

Subscribe to our mailing list to get the new updates!